Institutional grade alternative datasets—alpha that ordinary feeds can’t see

Laplace Private Data goes far beyond quotes and fundamentals, surfacing 13F hedge fund moves, COT futures positioning, congressional trades, sentiment analytics, and more. These unique signals arrive through a single, normalized API so you can enrich platforms, models, and dashboards with insights usually reserved for elite desks.

Why quants & product teams pick Laplace private data?

We're challenging conventions and pioneering a new tech-forward, transparent approach to market data APIs.

True alternative edge

Institutional filings, insider behavior, and social sentiment—all structured and timestamp aligned with price data.

One schema, zero scrapers

Forget parsing PDFs or stitching CSVs; every dataset uses Laplace’s AI ready JSON format.

Transparent pricing

Each request costs 5 credits; credits never expire and bundles start at $9.

Everything you get

13F Hedge Fund Filings

See what the biggest funds bought or sold each quarter—perfect for “follow the smart money” screens.

COT (Commitment of Traders) Reports

Weekly positioning of commercials, specs, and hedgers across futures—great for macro & commodity models.

Congress & Senate Trades

U.S. Mutual Fund Holdings

Social & News Sentiment

Executive (Insider) Purchases

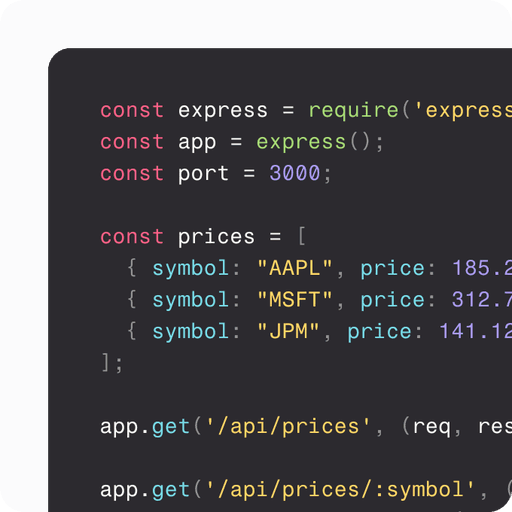

Quick start

GET

/private/13f

Quarterly hedge fund filings

GET

/private/cot

Weekly COT positioning

GET

/private/congress

Congressional trade disclosures

GET

/private/mutual

Mutual‑fund holdings & flows

GET

/private/sentiment

Real‑time news & social sentiment

GET

/private/insider_plus

Enhanced insider transactions

Get started today.

Get instant access to institutional-grade financial data with no setup required.

Free developer tier includes 10.000 credits for welcoming gift & limitless price data.